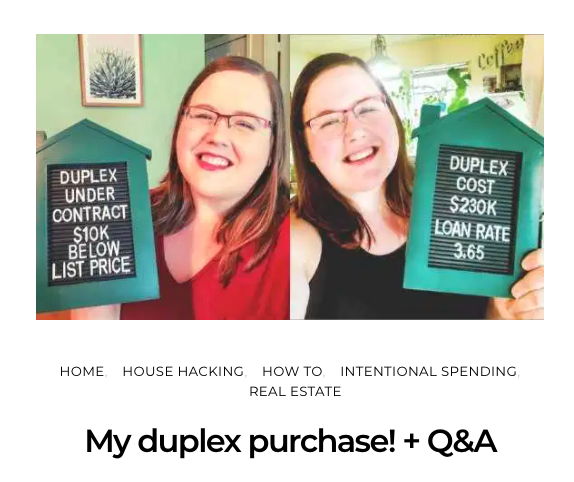

If you’ve followed my recent videos, you know that one of my goals in 2020 is to cash flow the down payment for an investment property, specifically a multifamily unit that I plan to house hack. I’ve even gotten a small letterboard to display my progress!

The premise for house hacking is simple: find a property with at least two units, live in one and rent out the others. Ideally the rental income should meet or exceed the monthly costs of the entire home, which leaves you with someone else paying your mortgage and the option to free up the money you would be paying for the mortgage with to build other wealth.

UPDATE: Check out this video on how I now use this strategy to pay just $150 per month for my total housing cost with it!

Learn more about my plan to buy multifamily real estate and why here:

I’m a total beginner to this, so I’m learning along the way and hope to share what I learn with you. I’ve looked at several different properties, done extensive research on potential problems and listened extensively to anyone with more experience than me that is willing to teach. Here are some things I’ve learned, I hope they help you as well if you’re looking to buy a home, rental property or multifamily unit.

Let’s talk real estate!

Real estate investing is a time game. You stand to make the most money by selling your home after decades, as property values increase, not just a few years. So choosing a home in an area that will gain in value and stand the test of time are paramount.

Finding the right neighborhood

When looking at Zillow or a internet home listing, it can be hard to tell the state of the surrounding neighborhood. And even if it appears well-kept, you must look deeper to make sure you’re fully informed.

Look at other listings in the neighborhood. Is the area growing, or are homeowners leaving? If there are a lot of listings, maybe there is a reason for the exodus.

If you aren’t already familiar with the community, you’re going to want to put in the legwork to make sure it’s worth investing in.

Some factors that you should always look into before making any housing investment are local crime statistics, property taxes, whether appraisal values are rising or falling, and the overall character of the area.

A great way to get a feel for the neighborhood is by talking to people who reside there. Go out during the day on a weekend and see who is walking around. Speak to them. Ask if they have any noise issues, parking, rowdy children/ teens, etc. Bonus points if you can speak to an older woman, they nearly always have their fingers on the pulse of the area and can and will tell you more than you need to know about everyone and their uncle.

In a pinch, a more cursory way to gauge a neighborhood is by assessing the vehicles, lawns, and

decorations. Are there derelict vehicles in driveways with long expired inspection tags or stickers? Toilets in the front yard? Are the lawns manicured and trees trimmed? Do people decorate for the holidays or display their names on the mailbox or front door? Does the neighbor’s home look like Boo Radley’s house? Appearances can be deceiving in life, but not in a whole neighborhood.

Consider your ideal renter

Who you want to rent to should determine what priorities you have when house shopping.

If you hope to do short-term rentals or a vacation AirBnB or VRBO, you should consider your consider your proximity to entertainment venues and attractions and accessible parking.

See my video on testing out tiny house living to learn more about if I’d like to buy one as a short term rental!

Medium-term rentals such as for college students or young professionals? Look for properties with 2 or more bedrooms and proximity to the university or large companies, shopping, and bus stops.

Long-term tenants like families? Check out the local school districts, parks, sidewalks and crime statistics.

Hidden gem or heap of junk?

Why is this home on the market? If a rental property is drawing a profit, you have to figure out why an investor would sell it.

Research the previous listings for the properties you’re interested in. Has it changed hands several times? If so, why? Is the previous owner selling it for a loss? Has this house ever been a crime scene?

Realistically, you’re going to have to invest some money into any property, and you should definitely arm yourself with as much knowledge as possible.

You have to be careful that you aren’t taking on a home that someone is trying to offload because it needs a lot of work, which is often a reason for rental properties to change hands. A sink or toilet can be replaced, and a whole home can be remodeled if it has good bones.

However, foundation, mold and structural things are a huge money suck. Even a roof replacement could mean adding years onto your debt or profit plan if you go in unprepared. Crunch the

numbers on possible repairs before going all-in and then double the estimated repair costs. That might cover it.

Pricey problem areas

These signs of wear are good benchmarks to determine whether your new home is going to need

some serious work. Don’t be afraid to look in nooks, crannies, cabinets, and cubbies for any of these warning signs!

Signs of shifting that may indicate foundation problems:

- Doors or windows that won’t close easily, hang open, or stick

- Cracks in the walls or ceilings, especially above doors or windows

- Uneven, bowed, or sagging floors

- Cabinets or counters that have shifted away from the walls

Signs of roof damage:

- Ceiling stains might indicate a leak

- Damaged or missing shingles

- Rusted, clogged, or broken gutters

- Mold on the exterior, or near corners or joints

- Higher energy bills, especially in the summer

Signs of plumbing damage:

- Rusted, corroded, or leaky pipes

- Rattling pipes

- Slow drainage

- Low water pressure

- “Stagnant water” smell

Signs of electrical issues:

- Buzzing sounds

- Outlets that become warm or hot after use

- Check for lightning damage!

- Burning smells

- Ungrounded appliances and fixtures: you shouldn’t get shocked by your washer or dryer

- Rodent activity

Signs of pest issues:

- Damage near entry points, especially gnaw marks

- Rodent, racoon, or squirrel scat

- Bird or rodent nests – check your attic or basement!

- Animal trails, footprints, grease marks

- Dead pests or vermin, large quantities of pesticide on the premises

Serious buyers only!

This article isn’t the ultimate resource on what to look for when you house hunt, but I encourage you to be as informed as possible when shopping. Don’t neglect the advice of your realtor or agent, as they can be a valuable ally in making a sound financial choice.

Read more: