With a recession looming, inflation rising, people losing their jobs and the sky feeling like it’s falling on the news every day, we’re all trying to do the best we can with what we have. If things are high stress concerning money, and you’re anxious about the future, you aren’t alone. But there are things we can do to feel and be more prepared right now.

None of these cost any money and can absolutely make you both feel and be more prepared for what we’re facing, help you feel more in control and manage stress and anxiety.

1: Take stock

Make a pantry, fridge and freezer inventory – when you know what you have you can make a plan on how to best use your resources I have a free printable here, but a pen and paper also does the job just fine.

Use some general categories like meats, veggies, grains, etc. to help you stay organized because just a long list isn’t going to help you with the next step.

2: Make a meal plan

Create a list of meals using primarily what you have! I’ll link some websites that can help you search recipes based on ingredients. If you do need items, make a list. We waste money when we shop without a list and so many people are stocking up on things they’ll never eat or need. Be smart.

Ideas for frugal meals

On YouTube: My meal planning playlist. I have nearly 100 weekly grocery hauls going back YEARS with grocery hauls and meal plans at budgets ranging from $50-90. I go through recipes too!

Other helpful Budget Girl resources on meal planning

- How to clean out and inventory your freezer + free printable

- The Best Frugal Things at ALDI

- Easy Fall Crockpot Recipes – Chicken Taco Chili

- Things to STOP Wasting Money On

- How to get the FREE thanksgiving dinner from Ibotta in 2022

3: Make a budget.

If you haven’t made or used a budget before, now may not seem like the time, but it absolutely is. In times of crisis or unknowns, it is imperative to know your true money situation.

Here’s the most basic primer on how to make a budget. You can decide on what type works best for you later, but this will get you started.

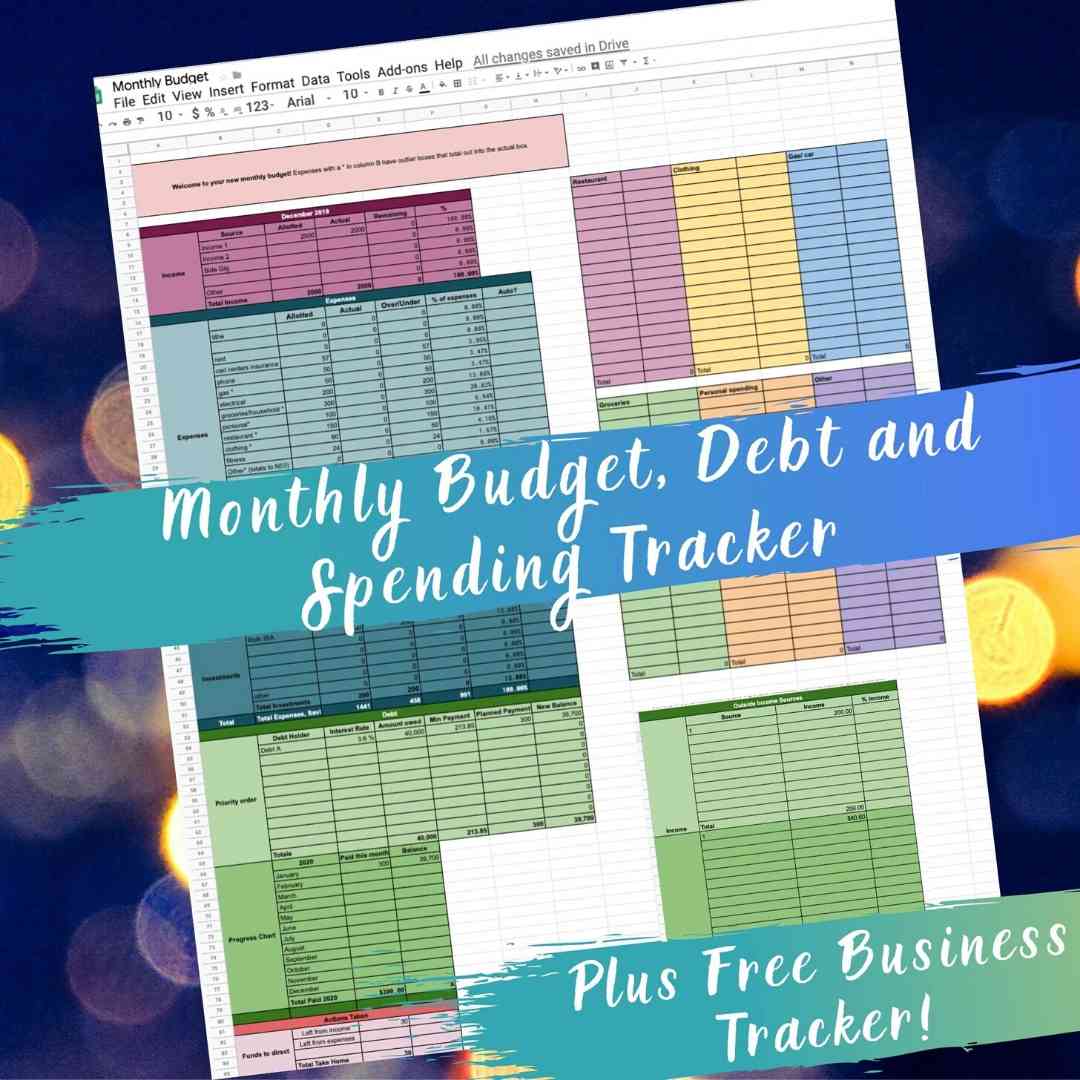

If you’re a digital person, you can grab my budget template here.

It comes with a complete tutorial on exactly how to set it up and use it, and I personally offer support if you have issues. I also have years of tutorials using this budget system to meet some massive money goals including paying off $33k of debt, saving an emergency fund, saving/ investing 40% of my completely normal income and now buying a home.

4: Make an “emergency budget”

Wait, wait wait. ANOTHER budget?

YES! Stay with me here and you’ll be so glad you did.

An emergency budget is going to be an amazing tool for you.

Even if you already have a budget, make an emergency budget. This budget will help you figure out the very minimum you need to make to live on. And it will serve as a plan for you in case of any emergency, be it a pandemic, job loss, illness, or other bad situation.

It’s a scaled-down budget that includes your necessities only. Rent, electricity, food, gas. medications, etc. The essentials.

It does not include: entertainment, restaurants, fun money, clothing beyond what is absolutely necessary, subscriptions, savings, additional investments or anything beyond minimum payments on debt.

Once you know this number, I promise you, you will have peace of mind and probably a big weight off your shoulders.

Because this number is going to be surprisingly small. If you normally spend $5,000 a month, and really go at your budget with an axe, cutting out saving, investing, subscriptions, clothing, eating out and all that, you might be able to stretch your current income for 2-4 months.

Now if you have to use this budget, it’s not going to be the most fun time, I won’t lie. But you’ll be able to live, eat, keep a roof over your head. It’s meant for emergencies.

If you create this budget while your mind is clear and you aren’t in panic mode, you’ll be able to walk around with the knowledge that you have an emergency plan for your money, you’ll know what to do in case something bad happens and not have to make those decisions in an emotional state.

Having an emergency financial plan is powerful. It is a gift you can give yourself, completely free.

–

5: Money moves to make if your work is insecure

Now is the time to pile up savings if you have lost or may lose some or all of your work.

Stop any additional debt payments and see if you have any forbearance or difference available to you. If you have federal student loans, you can ask to defer them. Student loan interest is currently suspended so this is the only time you can hit pause on your student loans without having interest be compounding while you aren’t paying.

A note, if your job is not in a lot of danger, and you have the resources available, now is actually a good time to invest. The markets always bounce back over time, but DO NOT take on debt or spend money you can’t lose by investing right now.

Check your available financial resources.

Do you have any savings accounts or sinking funds that you can access? A lot of people are out there chiding people for not having emergency savings but I don’t think this is the time or place.

We’ve all been hit up the side of the head by this and all of us can only do what we can with what we have right now. Hopefully yes, this will inspire people to create an emergency fund once this is all over, but please be kind to each other right now.

Really in a bind with no savings?

If it comes down to you need money for food or rent and have no other options, I do not recommend cashing in any retirement savings. Considering the penalties and state of all our portfolios, it may even be a better choice to take on some credit card debt. None of these are great options, but if you have to take a bad option, take the least bad option you can.

Additional resource: What to do if you get evicted

6: Add a stream of income

Even “drops” of additional income can help a dire situation.

I have a whole page on vetting different side hustles here.

An article on how to make money quickly here.

And an article/ video on side hustle failures here – in case you need a laugh or to learn from my mistakes.

And learn where to sell anything for the best price, a simple guide here.

7: Don’t be too proud to ask for help.

Look for the helpers. There is zero shame is accepting help, be it from the government, family, friends, etc. Ask your friends and community what resources they have and are available.

Check churches, your city’s social media pages, and other communities you’re a part of for help. Food pantries opening their qualifications, and programs being put into place to ease people’s burdens. And of course, if you can help, offer.

8: Feel more in control by controlling what you can

Get your house in order

This is the weirdest advice but it’s totally a thing. When you’re feeling stressed and stuck, it can help to do what you can around you. It’s a mental break and has a physical benefit to you and your surroundings.

Keep your laundry going, keep things clean and neat. Tidying is the most productive discrattionary thing you can do. It’s totally free and it will help you feel instantly accomplished and more in control.

One last thing

Try to remember that as bad as things may seem, all storms pass. Take care of yourself, your family and others if you can. Be kind, and try to keep yourself strong mentally. Panicking leads to bad and costly decisions.

Let’s chat! Safe space

What are you doing to feel and be more prepared right now?

Read these articles for more money tips:

How to deal with financial setbacks

How to prepare for the holidays amidst rising costs & inflation

Get the FREE Thanksgiving dinner from Ibotta (not sponsored) 2022